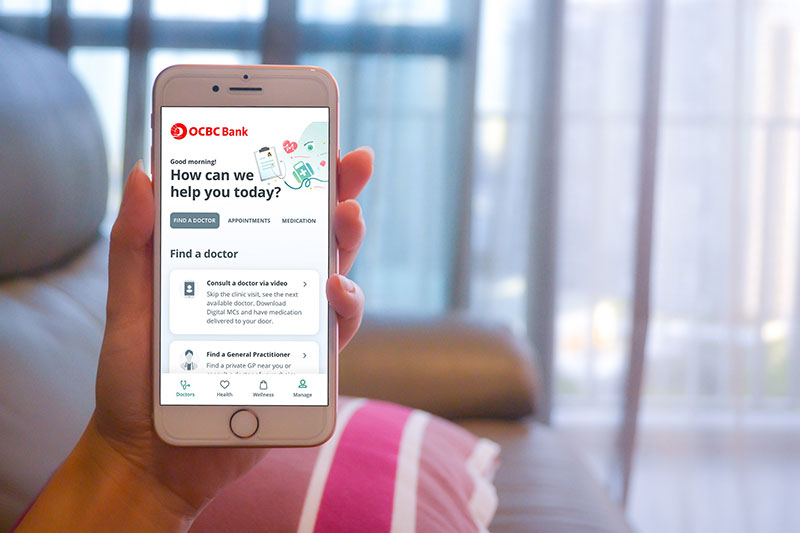

As Singapore enters a safe re-opening phase, OCBC Bank has partnered with seven medical groups to launch the HealthPass by OCBC mobile app, providing access to more than 100 general practitioners (GPs) and specialists. The app will address the healthcare needs of all Singapore residents over the age of 18, including non-OCBC Bank customers.

Read more How FDA is Backing the Use of Artificial Intelligence in Telemedicine

Video consultations with both GPs and specialist doctors can be booked and administered through the app, with medication delivered to the patient’s doorstep, reports OCBC.

The consultation fee is kept flat at S$20 for each telehealth and in-clinic visit to a GP during normal operating hours. Patients pay a flat fee of S$100 for the first telehealth or in-clinic consultation with any of the 63 specialist doctors from 21 specialties including gynecology, pediatrics, cardiology, dermatology and oncology, which are among the top fields of specialist medicine Singaporeans often seek medical advice for. Medication and diagnostic procedures are charged separately based on current practices.

Singapore Medical Group, one of the partners for HealthPass by OCBC, estimates that there has been a 60% surge in specialist tele-consults since the onset of COVID-19. Apart from Singapore Medical Group, the other medical partners for HealthPass by OCBC are StarMed Specialist Centre, Thomson Medical, Faith Medical Group, OneCare Medical Group, Etern Medical and True Medical.

HealthPass by OCBC integrates directly with the healthcare partner’s clinic management systems, and information is only accessible by users and their doctors, which provides personal data privacy and security. Patients can also access digital Medical Certificates (MC), clinic invoices and laboratory results from the clinics visited securely through the app. This makes it convenient for patients, especially those with on-going medical needs, to easily retrieve past records for doctor consultations without the hassle of retrieving hard copies and maintaining a physical file.

The wellness shop in the HealthPass app gives users access to more than 100 merchant offers for wellness products and services. Patients also do not need to make physical cash or card payments. Once a credit or debit card is added to the app, payments to clinics and the online store are processed digitally, and the app helps users to track all costs in one place.

Consulting a doctor through telehealth safeguards individuals more susceptible to the effects of the virus, such as the elderly, those with underlying conditions and expecting mums, allowing them to seek timely medical help with relative safety. It also helps doctors to conduct follow-up consultations with patients, especially those with chronic ailments.

Read more Vuzix M400 Smart Glasses Continue Their Expansion Into Remote Care For COVID-19 Patients

“COVID-19 will eventually pass, but its impact on the community will be long felt, and widespread access to telehealth will provide a big boost to help manage Singapore’s healthcare needs,” said Mr Pranav Seth, OCBC Bank’s Head of Digital and Innovation.